The CEO’s Dilemma: Why Executive Isolation Is Your Biggest Strategic Risk

Feb 16, 2026

Today we're addressing a problem that gets whispered about in boardrooms but rarely confronted head-on: executive isolation. Are you feeling isolated?

Reviewed by Thuy Sindell, PhD. Written by Milo Sindell, MS.

Published on November 3, 2022

9 minute read

CEO Life in 2023 is Tough: Four Things CEOs & Companies can do to Boost Tenure, Thwart Complacency and Improve Bad Succession Planning

The role of the Chief Executive Officer (CEO) is without a doubt the most significant leadership role within a company. Whether an S&P 500 or start-up, the CEO is the face of the business; he or she shapes organizational culture and embodies what the company stands for, and is accountable for results.

For better or worse, awareness of the significance of the CEO role has extended beyond the world of business and into popular culture. The reputation of the CEO can live or die based on the professional and personal actions he or she takes, and, as a result, what is said about him or her on the Internet.

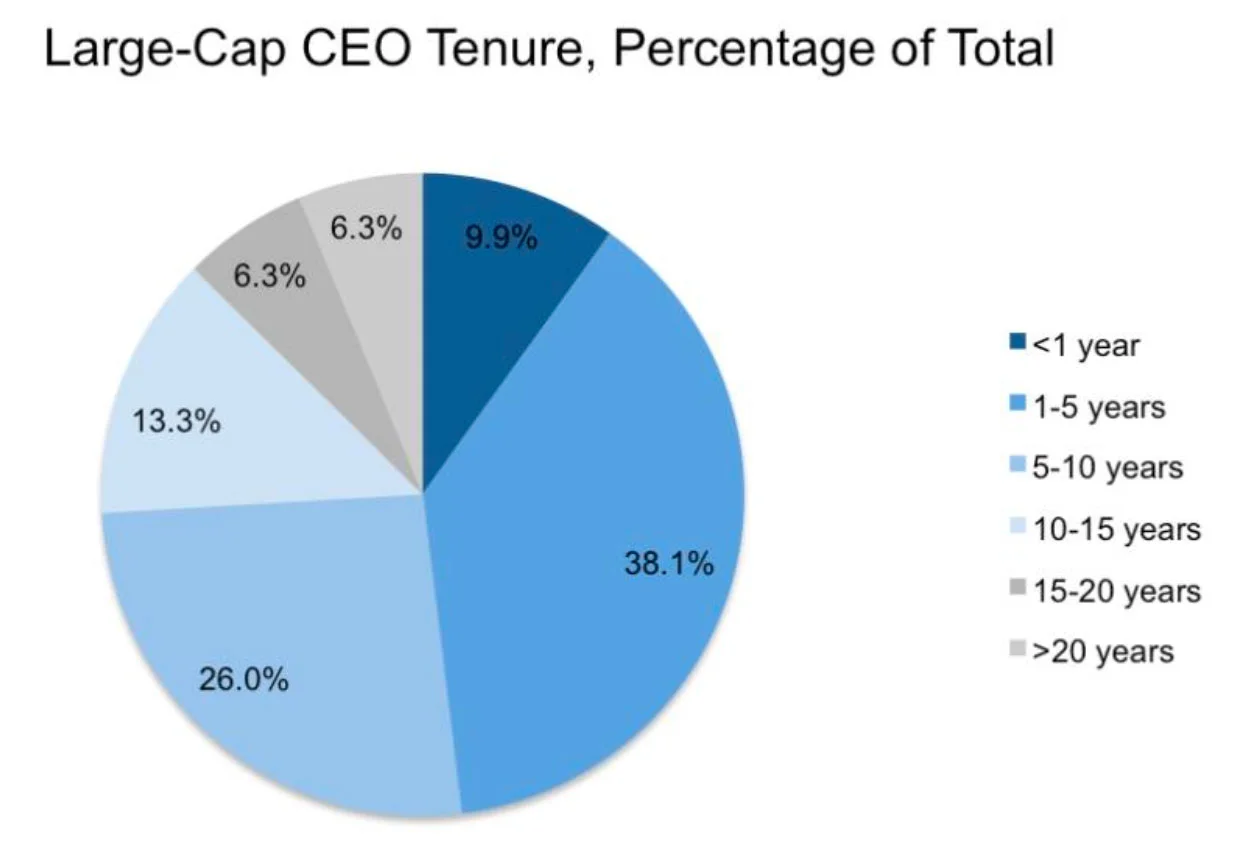

At the same time, CEOs are getting less time to make their mark on an organization; median tenure for CEOs at S&P and large-cap companies has dropped from six to five years since 2013, according to the Harvard Law School Forum on Corporate Governance and Financial Regulation. 1

So the question becomes: If CEO tenure is shrinking and public scrutiny is growing, how can CEOs and organizations drive performance despite greater internal and external challenges?

This white paper reviews trends, practices, and opportunities that companies can take advantage of to improve business performance by:

Understanding these issues will help unwanted CEO turnover and help companies plan their CEO successions.

A CEO is the highest-ranking executive in a company. The role of chief executive officers is to be the main point of communication between the board of directors and the C-suite, and are responsible for managing the overall operations and resources of the company. 2

On a less operational and more human level, CEOs set the tone and vision for their organizations. What the CEO says and does affects how employees and customers perceive the organization—inside and outside the office.

From the outside world the life of a CEO may seem glamorous but in actuality, the day in the life of a CEO and the truth about CEO life is quite different.

Today’s CEO lives an increasingly public life in which his or her actions can be disseminated and dissected by anyone with an Internet connection. This relatively new dimension to the role has been cited as one of the reasons why average tenure has been falling in recent years.

Between greater scrutiny, higher short term shareholder expectations, and existing business risks, both younger executives and senior executives in publicly traded companies as well as private companies are rethinking their career trajectories.

As leaders are considering the changing landscape so are companies in terms of their strong leadership mandate, the impact of forced CEO departures, CEO succession announcements, and interim CEO appointments.

The CEO position was once viewed through a more long-term lens; however, current average tenure lasts much closer to five years. In 2017, almost half of CEOs at S&P 500 and other companies had been in their position for five years or less, according to the Harvard Law School Forum on Corporate Governance and Financial Regulation. 3 This data includes CEO’s who leave on their own as well as forced CEO departure.

There are three possible reasons for the fall in tenure and shrinking of the CEO tenure and life-cycle of CEO’s over the past five years.

Given the shrinking and shorter average tenure timeframe in which CEOs have to act and the increased public scrutiny of the role, here are four ways CEOs and organizations can drive performance:

One of the results of falling average tenure has been CEOs’ taking decisive action quickly after stepping into the role. This makes sense, as new CEOs must make their mark against the backdrop of a ticking clock.

CEOs better make the right moves right now, or their jobs may not be theirs for as long as they want.

Luo, Kanuri, and Andrews reinforce the notion that early on is the ideal time for new CEOs to make big moves. They posit that as outsiders to the organization, new CEOs are more attuned to and therefore more responsive to the external environment, which assists them in strengthening the organization’s relationships with customers.

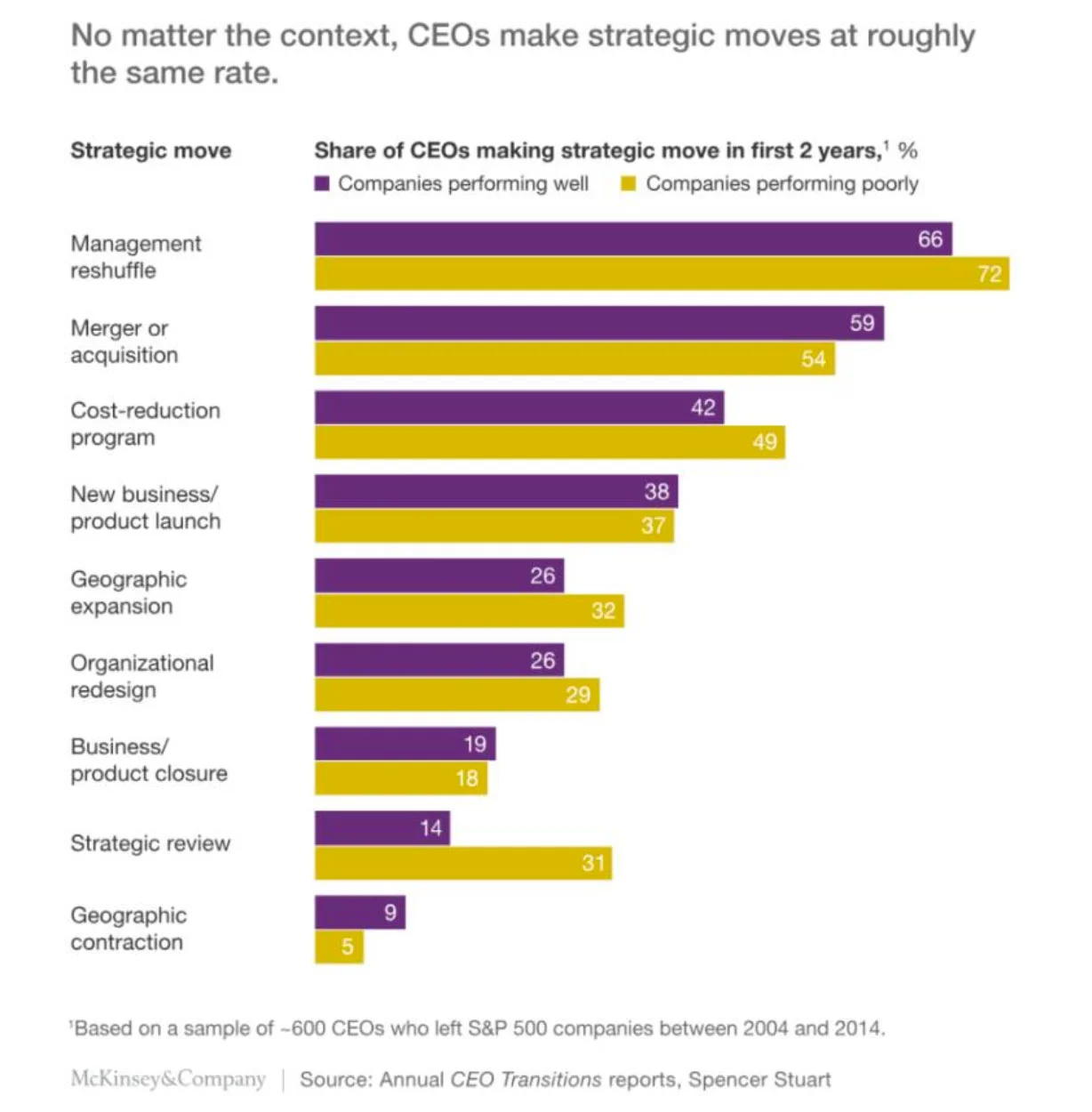

McKinsey has identified some common actions new CEOs take when they start their tenure, including reshuffling top management, mergers and acquisitions, cost-cutting programs, and new product launches.

It is important to note that these bold strategic moves tend to be higher risks for CEOs of well-performing companies.

If the company is already doing well, a bold, new initiative carries the risk of setting the company down a less successful path—“Don’t fix what ain’t broke,” as the saying goes. But if the company is not performing well, then shaking things up is usually welcomed, as there is less downside to calculated bold action.

While new Chief Executives are praised for their decisive actions and outsider thinking, more tenured CEOs at S&P 500 and other companies labor under the perception of being too inward-focused and risk-adverse. According to Luo, Kanuri, and Andrews:

“In their later seasons, however, CEOs myopically commit to obsolete paradigms, become risk averse and stale in the saddle, and tend to adapt less to the external environment… thus hurting firm performance.”

Research by PWC reinforces this notion of a detrimental “insider” perspective. In their 2016 Chief Executive Success Study, they found that Chief Executives hired from outside the organization have delivered higher median total shareholder returns than insiders for the past four years.

As tenure increases, it is easy to become entrenched in what you know and less open to outside information. The message here is clear: CEOs at S&P 500 and other companies must maintain an outsider perspective to be able to adeptly respond to what is happening in the market. An outsider perspective is one that is characterized by market/external focus, growth/innovation centricity, and optimizing of company culture.

Over the past five years, the percentage of CEOs at S&P 500 and other companies forced out of office for ethical transgressions increased in every region analyzed by PWC:

Furthermore, total forced turnovers for ethical lapses rose 36%, from 3.9% to 5.3%.

With the proliferation of digital paper trails—which hold CEOs and other leaders accountable for the decisions they make—and the 24/7 news cycle— which increases the likelihood that word of an ethical lapse will go viral—it is important for CEOs to scrutinize their own actions through the lens of public perception before acting on them.

CEOs must see themselves as public figures, embracing the public nature of their roles and using it to their advantage. This is not about exploiting public opinion. With people growing increasingly wary of big corporations and the people who run them, any whiff of deceit will undoubtedly be discovered and used against you. This is about genuinely connecting with internal and external audiences and acting in a way that is aligned with their—and hopefully your—ethics.

As the CEO, how would you feel if whatever action you are about to take became the front page headline of The Wall Street Journal? How would your board feel? Let those answers be your guide.

One other possible reason for shorter CEO tenures is poor CEO succession planning on the part of organizations. A PWC 2016 CEO Succession Study noted that CEOs who step into the role after a forced exit have shorter tenures than those coming in after a planned CEO succession, a median of 4.2 years compared with 5.6. They posited that “companies that lack good succession plans are setting themselves up for more frequent turnovers.”12

Furthering this point of view is that in the past 15 years, higher performing companies have had planned turnovers 79% of the time versus 55% of the time for low-performing companies, according to the study. Better performing companies plan for departing CEOs, they position themselves for seamless leadership turnover from CEO succession announcements to supporting the new CEO as they integrate into their role.

At the foundation of successful CEO succession planning is a pipeline of strong and diverse future leaders. One clear area where most companies are failing with CEO successions are in the lack of gender diversity in their pipelines.

In 2016, only six of the 63 CEO positions that became available in the S&P 500 were filled by female CEOs. And while this figure seems sadly low, the total number of women CEO appointments in Fortune 500 is at an all-time high of 32, which, perhaps, makes it even sadder. These numbers are also the same in terms of interim CEO appointments. These low numbers reflect the trend of departing female CEOs.

There are many reasons why women CEOs remain elusive, most of which have to do with poor CEO successions. In a business world that has long been run by men, women have simply not had the range of opportunities, broad experience, or professional networks necessary to be hired for or be as successful as male CEOs. This begs the question of what do public companies and private companies need to do to support the pipeline of future and incoming female ceos?

To promote diversity in pipelines and, ultimately, future organizational success, companies must provide leadership roles and development opportunities for women, so that when CEO and other C-suite positions become available, there are women primed to perform at that level.

Today’s CEO has a shorter time-frame in which to make his or her mark. In addition, there is increased public scrutiny on every move made—inside or outside the office. This environment calls for new thinking and actions for CEOs and organizations to drive performance. These four actions include:

New CEOs have to make the right moves right now, or the job may not be theirs for as long as they want. For incoming CEOs, the “right moves” will depend upon current performance, changes that are truly beneficial, and having the right metrics in place.

As tenure increases, CEOs can become entrenched in what they know and less open to outside information. CEOs must maintain an outsider perspective to be able to continue responding to what is happening in the market. Today’s CEO’s mindset must be one of growth, innovation, and company culture evolution.

The proliferation of digital paper trails, the 24/7 news cycle, and increased skepticism regarding big business means every move a CEO makes must be evaluated through the lens of public perception—before it is acted upon. CEOs must embrace the scrutiny of the job and the fact that like professional athletes or actors, they are in the public eye.

Weak pipelines can lead to unprepared and low-performing CEOs. To drive future organizational success, companies must provide leadership roles and development opportunities to diverse populations, so that when CEO and other C-suite positions become available, the right people for the jobs are primed to perform at that level.

Founder and President

Executive Coaching Division

Thuy Sindell is the President of Skyline Group's Coaching Division, an executive coach, and author. Skyline's Coaching Division manages over 170 coaches, facilitators and consultants worldwide. Thuy's executive coaching experience spans over 20 years with companies across a number of different industries and sizes from technology to insurance and from start ups to Fortune 500s.

President

Coaching Scaled Division

Milo Sindell has over fifteen years as a business and human capital expert. He worked as a senior consultant for Intel and later at Sun Microsystems in areas including strategy development and implementation, change management, knowledge management, and leadership and employee development. At Skyline he is focused on market positioning and product development for Skyline's coaching technology solutions.

Feb 16, 2026

Today we're addressing a problem that gets whispered about in boardrooms but rarely confronted head-on: executive isolation. Are you feeling isolated?

Feb 3, 2026

Crossing the $1 billion threshold, whether in annual revenue, valuation, or market capitalization, is one of the most celebrated milestones in business. It validates years of founder vision, product-market fit, and relentless execution. But for the leaders who reach it, the celebration is short-lived. The operating model, decision-making habits, and leadership style that propelled the company from zero to $1B are suddenly insufficient for what comes next.

Jan 14, 2026

Discover how AI is reshaping executive coaching in 2026. Explore the top 5 leadership trends from agentic AI and human-AI collaboration to change fitness, ethical governance, & the irreplaceable human skills leaders need to thrive.

Jul 16, 2025

To be successful in the AI era leaders must master the human side of business. These 8 critical skills turn artificial intelligence from threat, to superpower.

Contact us today to get started